testnet ecosystem

AMBRA WALLET

Ambra is a trustless, self-custodial and open-source wallet for your Bitcoin and tokenized assets on Sequentia.

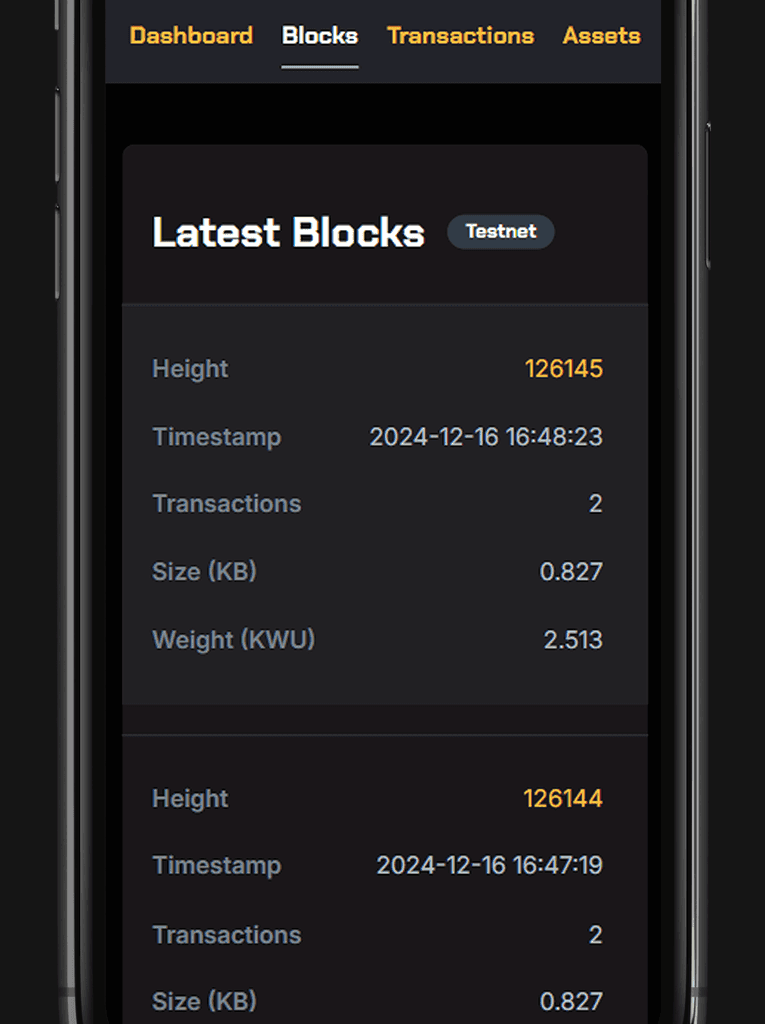

BLOCK EXPLORER

A dedicated web tool to visually examine Sequentia's blockchain data and cross-check transactions.

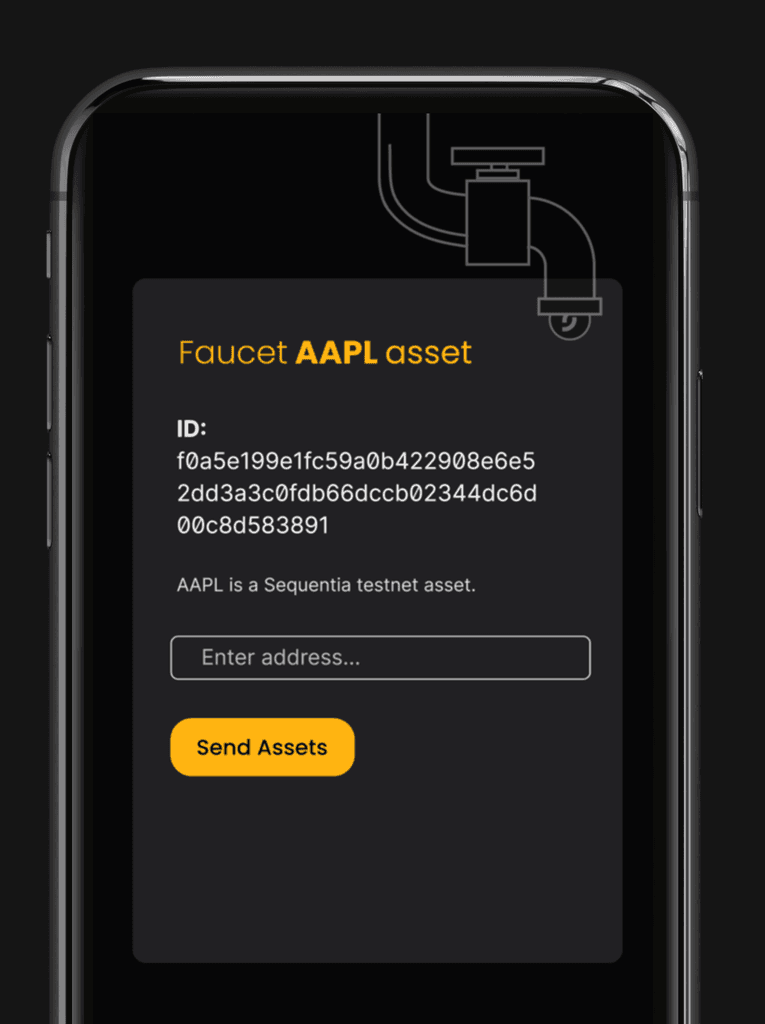

SEQUENTIA FAUCET

Claim free Sequentia testnet tokens for your Ambra or CLI wallet.

Frequently asked questions

Join our Socials

for exclusive updates and news!